louisiana estate tax return

For fiscal year taxpayers returns and payments are due on the 15th day of the fifth month after the close of the fiscal year. General Tax Phone Support.

Estate Tax Examples Of Estate Tax Estate Tax Rate

Yes Louisiana imposes an estate transfer tax RS.

. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Box 201 Baton Rouge LA 70821-0201 225 219-0067 Inheritance and Estate Transfer Tax Return Mark one.

Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Send to the Correct Address. The estate would then be given a federal tax credit for the amount of state estate taxes that were paid.

Non-resident LA state returns are available upon request. Please wait at least 60 days before checking the status of your refund on electronically filed returns. Final individual federal and state income tax returns each due by tax day of the year following the individuals death.

How do I send my tax return by mail. Direct Deposit is available for Louisiana. Httpseswebrevenuelouisianagovcontactusdefaultaspxwhoin 2020 State Tax Filing Deadline.

31 rows Generally the estate tax return is due nine months after the date of death. Completing Form IT-541 Fiduciary Income Tax Return Who Must File a Return Louisiana Revised Statute RS 47162 provides that every resident estate or trust and every nonresident estate or trust deriving income from Louisiana sources is liable. But everybody should be aware of the rules.

If you filed a Louisiana return and indicated that your refund be direct deposit and you gave TurboTax the bank routing number and your account number then as Julie said above you need to contact the State of Louisiana to see if the direct deposit failed so you can update the info. For other forms in the Form 706 series and for Forms 8892 and 8855 see the. Does Louisiana Have an Inheritance Tax or Estate Tax.

If you are mailing a check for the Louisiana taxes due include the R-2868-V payment voucher along with your payment and mail to. Louisiana Estate and Inheritance Tax Return Engagement Letter - 706 To access and download state-specific legal forms subscribe to US Legal Forms. It can take 12 to 14 weeks to receive your refund.

Automate manual processes and eliminate human error with Sovos tax wihholding solutions. Louisiana tax returns are due on or before May 15th. Check the IRS website for where to mail your tax return.

If you have income tax questions or need technical help while filing your returns online you can call the Louisiana Department of Revenue at 1-855-307-3893. Fortunately only 1 or less of total households are required a file an estate tax return. Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day.

E-Filing non-resident LA state returns is not available. 420 pm Online Contact Form. The gift tax return is due on April 15th following the year in which the gift is made.

Preparation of a state tax return for Louisiana is available for 2995. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount.

Every resident estate or trust and every nonresident estate or trust deriving income from Louisiana must. When Are Louisiana Tax Returns Due. Box 751 Baton Rouge LA 70821-0751.

Just because Louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far as the IRS is concerned. Fiduciary Income Tax Who Must File. Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only Stocks and bonds Mortgages notes and cash Insurance Other miscellaneous property.

In fact you may have to file all of the following. The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax.

Simply select the form or package of legal documents to download print and fill out. Louisiana Department of Revenue Taxpayer Services Division P. Deducting LA Income Tax.

Louisiana does not levy an estate tax against its residents. If you pay LA income tax the IRS allows you to claim a deduction on your federal tax return for them. The Louisiana Department of Revenue manages collection of the states individual income tax as well as other taxes like Louisiana sales tax consumer use tax gift tax and estate transfer taxes.

April 10 2020 1135 AM. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code. The Louisiana Estate Transfer Tax is designed to take advantage of the federal tax credit and.

Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. Check the Amended Return box sign the form and mail it to one of the addresses listed below.

Ad Accurate withholding repotting to federal state and local agencies for all transactions. E-File is available for Louisiana. Louisiana Department of Revenue PO.

When The United States Declared Bankruptcy Pledged All Americans As Collateral Against The National Debt And Confisc Birth Certificate The Body Book Law Blog

Will The Irs Extend The Tax Deadline In 2022 Marca

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

How To File Taxes For Free In 2022 Money

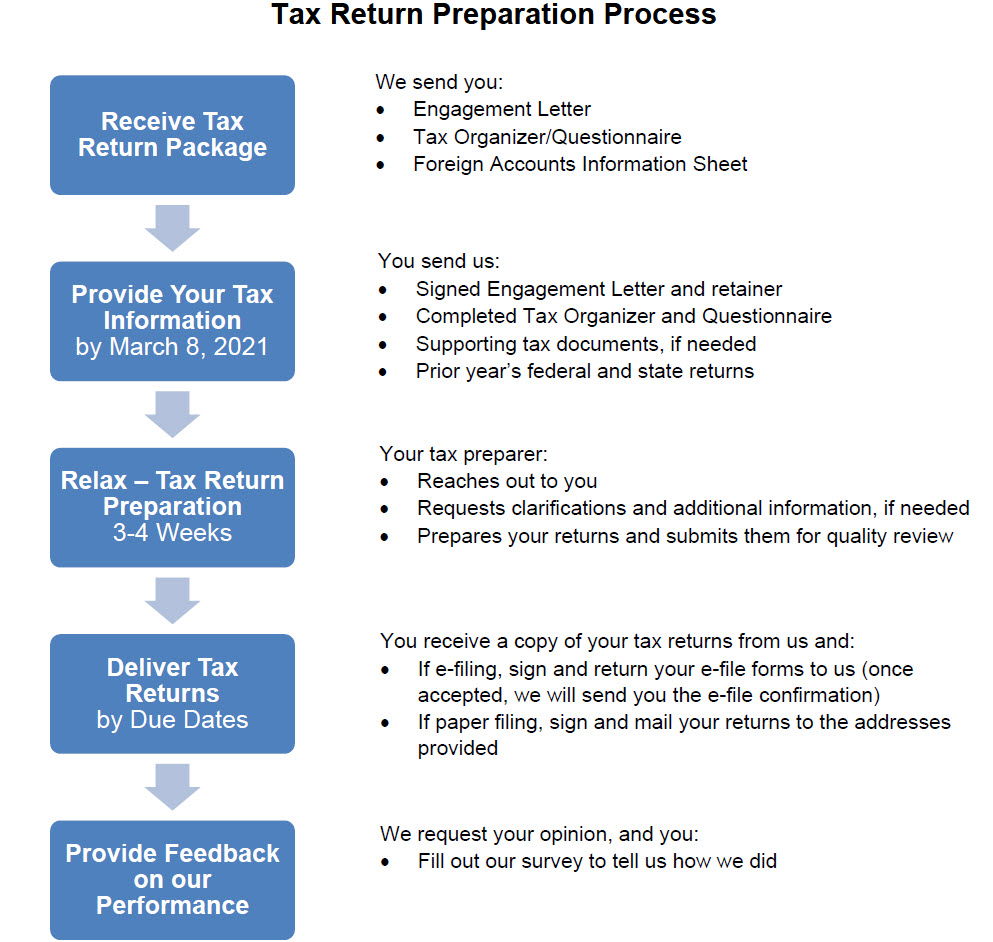

Tax Return Information The Wolf Group

Old Version Turbotax Business 2019 Tax Software Pc Download Tax Software Turbotax Tax Refund

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

1 897 Tax Refund Check Photos Free Royalty Free Stock Photos From Dreamstime

Tax Form Templates 5 Free Examples Fill Customize Download

Bond For Deed Bond For Title 0001 Real Estate Forms Real Estate Contract Word Template

Coco Crisp Selling A More Modest Mansion In The Desert For 1 9m Home Improvement Loans Modern Mansion Mansions

Deducting Property Taxes H R Block

The Differences Between Major Irs Tax Forms H R Block

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Tax Form Templates 5 Free Examples Fill Customize Download

Irs Delays Start Of Tax Filing Season To Feb 12

L A Clippers Chris Paul Lists Contemporary Mediterranean For 11 5m American Luxury Home Improvement Loans Home Financing Home Renovation Loan