are political contributions tax deductible for a business

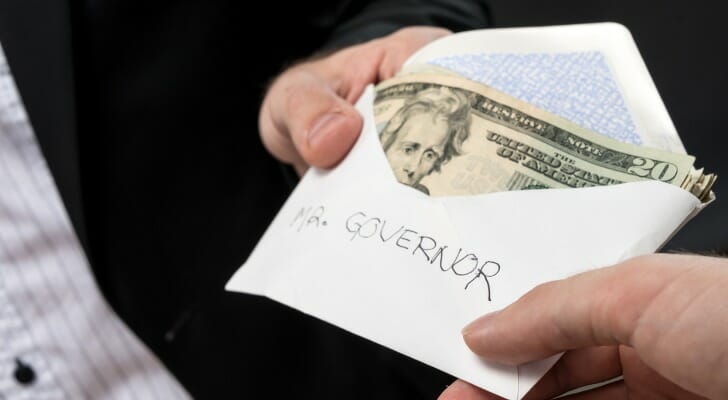

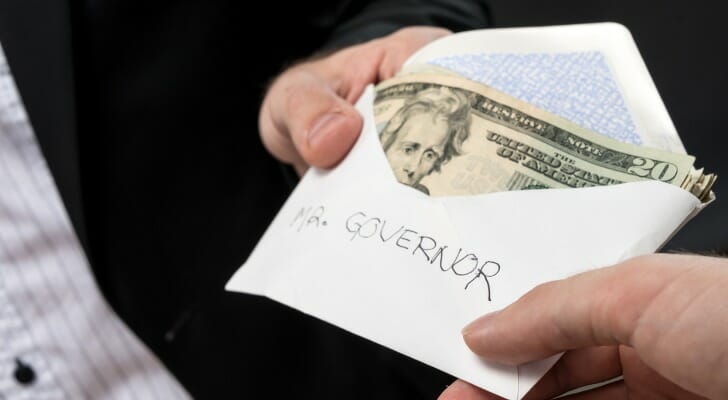

These business contributions to the political organizations are not tax-deductible just like the individual donations and payments. A tax deduction allows a person to reduce their income as a result of certain expenses.

Opinion Of Course Campaign Donations For Kennedy Stewart Cannot Be Claimed On Your Tax Return Vancouver Is Awesome

The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

. In comparison those sent by individuals or businesses to non-profit organizations hospitals and other organizations are received at a deduction. You cannot claim political deductions on your tax return for your business. Political Contributions and Expenses Paid.

You cannot claim political deductions on your tax return for your business. Required electronic filing by tax-exempt political organizations. Political contributions are made to cover the expenses made by the political party mainly for election campaigns.

A business tax deduction is valid only for charitable donations. The same goes for campaign contributions. This rule is so strict that the law even prevents political candidates from deducting the money they spend out of their own pockets while running for elected office.

Are political contributions tax deductible for a business. Are political donations tax-deductible for business. More specifically you cannot claim any amount paid in connection with influencing legislation as a business expense.

The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. Businesses may donate to campaigns political parties and PACs but their contributions will not be tax-deductible. Your business cant deduct political contributions donations or payments on your tax return.

To be precise the answer to this question is simply no. Among other provisions this legislation specifically amended IRC Section 527 j to require the e-filing of Form 8872 Political. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible.

Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns. And if you check the box when filling out your tax return that asks if you want to give 3 to the Presidential Election Campaign Fund that isnt deductible either. Donations to big organizations like United Way the American Cancer Society or the American Red Cross.

No donations to political websites are not tax deductable. Political Contributions and Expenses Paid by Businesses. Unfortunately that doesnt mean that the IRS bends the rules to allow you to benefit from your political contributions.

Ad Uncover Business Expenses You May Not Know About And Keep More Of The Money You Earn. Political contributions arent tax deductible. There are five types of deductions for individuals work.

If youre wondering if campaign contributions are tax deductible for your business the same rules apply. Normally charitable donations are tax-deductible but political contributions. If youre self-employed however you can deduct the cost of any supplies or services you donate to a political campaign.

No political contributions are not tax-deductible for businesses either. No Matter What Your Tax Situation Is TurboTax Self-Employed Has You Covered. This guide is designed for people who have made political contributions and are wondering about their deductibility.

Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed. The Taxpayer First Act Pub. 116-25 Section 3101 requires electronic filing by exempt organizations in tax years beginning after July 1 2019.

None of these contributions is tax deductible for either individuals or businesses. Are Political Contributions Tax Deductible for Businesses. Individuals usually make political contributions thinking that this will count as charitable contributions.

These donations must be itemized on your tax return in order to be deducted. It explains why political contributions are not tax deductible and it looks at other types of contributions that may be. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are.

36 Free Donation Form Templates In Word Excel Pdf Within Donation Card Template Free Cumed Org Donation Form Sponsorship Form Template Card Template

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible

Political Financing Handbook For Registered Parties And Chief Agents Ec 20231 June 2021 Elections Canada

Are Political Donations Tax Deductible Credit Karma

Tennessee Eagle Forum Newsletter Supportive Voter Mr

Step Toward Change Identity Column Five New Social Network Change Identity

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping